Pink Slip is devoted to topics related - however tangentially - to the workplace, business, management, the economy, lay-offs, etc. At least that's how it started out. Now it's whatever pops into my mind.

Tuesday, October 31, 2006

A Complete Lifetime Supply

Five thousand staples. FIVE THOUSAND STAPLES.

Hey, I like to staple as much as the next guy. Maybe even more so. In addition to two regular, plain vanilla staplers, I own two that are used for specialty jobs. One's for upholstery. In my case, since I don't actually upholster, I used it to staple new fabric on my dining room chair cushions. I may use it again someday. My other special stapler's a lllooooonnnnnggggg one, good for stapling booklets. Which I've actually done once, and which I may do again someday.

But I use regular, normal staples, too. Just not five-thousand staples worth. Let's face it, even a box of 1,000 staples, based on what's my likely usage of 10-25 staples per annum, will last me anywhere from 40 to 100 years. That should hold me!

When I was a kid I was quite intrigued by game shows that awarded winners a lifetime supply of something: Ship 'n Shore blouses, AquaNet hair spray, Quaker State motor oil. How, I always asked myself, could they possible know what a lifetime supply was. You could live longer. You could die sooner. Just what did constitute a lifetime supply.

Well, thanks to my new boxes of staples, I now know that I will never, ever, ever have to buy staples again in my life. (Whew, that's one less thing to worry about.)

Sunday, October 29, 2006

Jobs of the Past

In reading the book, I am noticing – and driven to distraction by - the number of times that dates and ages are used inconsistently. I know writers aren’t supposed to be good at math, but if your cousin little Steven was born in 1975, and your bar mitzvah was celebrated in 1981, little Steven couldn't have been 9 years old at your bar mitzvah. I’ve come across a number of little, annoying nits like this, which I may not have picked up on so readily if there wasn’t a handy-dandy family tree in the front that gave each “character’s” date of birth.

I could blame the author, Rich Cohen, but I don’t. I think there used to be people – were they called copy editors? fact checkers? – who were supposed to pick up on inconsistencies like this.

You don’t see all that many typos in published materials – let’s not consider “blogging” publishing – but you do see more and more of these little glitches.

Am I the only one that goes nuts about things like this, constantly back and forth-ing when the character’s eye-color changes from one chapter to the next (and it’s 1840, so there are no colored contact lenses), or when the older brother is suddenly the younger sister, or the boyfriend’s mother is now named Flo, not Glo?

It’s not just the internal inconsistencies that bother me. It’s the anachronisms, too. OK, if they're reading about something that took place in 1840, most people probably wouldn’t know whether or not the shoe button hook had been invented yet. But if they're reading a book that takes place in 1962, most poeple don’t expect someone to be driving a Mustang – and I’m one of them.

A few months ago I read a novel that took place during World War II.

Fact check: women of that era wore seamed stockings. Fact check: women of that era faced a nylon shortage and went bare legged. Fact check: women drew fake seams up the back of their legs to make it look like they had stockings. Fact check: women used Magic Markers to draw those fake seams. Now wait a minute: did women really use Magic Markers to draw fake seams?

No, no, no. If the author’s mother or grandmother never told her that they used eye-brow pencils, shouldn’t a copy editor have found this out? Didn’t the copy editor bother to do a simple google and find that Magic Markers weren’t invented until a decade later?

Isn’t this what copy editors/fact checkers are for?

And do they even exist anymore?

Or are they going the way of all those other lost professions – lamplighter, blunderbuss designer, muleskinner – that survive only in one of those Societies Dedicated to Keeping Alive Something We Don’t Need Anymore. Or in one of those replica villages that demonstrate how we used to live in ye olde dayes. (You know the type: the actor gets into ye olde mode and sits there scratching his cod piece - just daring you to notice - while he speaks as if it were still 1630 and demonstrate somes unimaginably stultifying task. “I noweth willeth showeth thee how I spendeth my worketh daye polishing the claws of dead roosters to maketh hair combes for the ladies faire.” The real purists don’t wear deodorant, brush their teeth with twigs, and no doubt use corn cobs for toilet paper. Makes you hope your cell phone will ring so you can answer and hand it to the guy. "It's for you. Says his name's Miles Standish.")

Is that what it will come to? Someday your children’s children will go to Publishing House Village, where they’ll watch fake copy editors checking facts, explaining exactly what they’re doing as they look things up in books and make caret marks with blue pencils. The kids will snicker and roll their eyes while the adults feign interest. Is that what it will come to?

(And, yes, there are no doubt typos and other glitches in this blog entry. Maybe there are still muleskinners somewhere. But, hey, I’m a blogger not a fact-checking-copy-editor.)

Saturday, October 28, 2006

Moneyball Redux

Detroit had excellent ROI, as well. For the regular season, in which they had a very strong Win-Loss record, Detroit posted an excellent return. Beating the Yankees and getting to the World Series was gravy.

The bottom line is that none of the big money teams were left standing - they were all left sitting in their dens watching someone else play on the 90 inch HD-TV flat screens they can all well afford.

No, it's not a pure Cinderello story - that would have been if the Marlins and Devil Rays had squared off - but it is nice to see relative little guys make it. (Of course, as a Red Sox fan (#2 in payroll), I can also argue that everyone other than the Yankees is a little guy: the gap between the Red Sox and Yankees payrolls is not much larger than the payroll of St. Louis or Detroit.)

Anyway, I look forward to seeing how the checkbooks come out this off-season as the big spenders continue to believe they're guaranteed (or entitled) to get what they pay for.

Friday, October 27, 2006

Alas, Ford Taurus...

go.

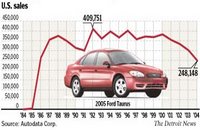

go.But go they have. (Sales were well down from peak, as you can see in this graph.)

In any case, I rented Tauruses (Tauri?) on several occasions. And we had enough Fords when I was a kid that I'm kind of sentimental about the brand.

Forbes was very savage (and quite funny) in their commentary on the demise of the Taurus, trashing Ford for not keeping the Taurus - which had been a pretty good car: decent quality, good mileage - up to date:

By failing to evolve what was once the best selling car in America, Ford Motor has given this country ten years of unadulterated blandness, polluting highways, streets and back roads with an aesthetic so generic that any self-respecting teenager should instead choose a scooter or a pogo ball as an alternate means of transportation.(Boy, am I glad I was never actually seen in one. And I thought my mother's Cutlass was a dud.)

The number of jobs that rolled off the assembly line with the last Taurus was about 2,000. That's a lot of pink slips, but nothing that those who work in the automotive industry haven't seen before and won't see again. Still, it will certainly amount to some misery and dislocation for those losing their jobs.

In googling around on the job losses, I found a NY Times article from 20+ years ago, that brings the Taurus job story full circle. This from May 1985:

The Ford Motor Company said it will place 2,000 hourly workers at its Atlanta assembly plant on temporary layoff beginning next week while the plant is being converted to build the company's new midsized front-wheel-drive cars, the Ford Taurus and the Mercury Sable.I don't imagine Ford has 2,000 replacement jobs up its sleeve this time. But this still remains the land of boundless (more or less) opportunity. The last Taurus was bought by the founder of the Chick-Fil-A fast-food chain, who credits workers at the Taurus plant with helping to get his business off the ground. Maybe some of the pink-slipped workers can find work at a Chick-Fil-A franchise.

Thursday, October 26, 2006

RIT Large: Dying for Good Color

Having worked for so many high tech businesses that are out of existence, I'm always curious about some product or other from my childhood that seems to have disappeared from the supermarket shelves. Does Ipana toothpaste exist anymore? (I can still remember the taste. And having done a quick google, if I want to check my memory on that taste, I can go to Turkey and buy a tube of Ipana there.) I think P.F. Flyers ("They fly down the street. Just look at their feet. They wear P.F. Canvas Shoes.") disappeared for a while, but they seem to be having a hipster resurgence. And I'm guessing that Lik-A-Maid, which was bitter and dyed your tongue orange-lemon-or-lime, is a goner, if only because the name would be considered too suggestive for today's crude world. (I guess the high-tech products I've worked on over the years aren't the only products to disappear from the market.)

But speaking of dye... I recently noticed that my navy blue bathrobe and my favorite, knock-around navy blue sweater, had gotten bleach stains on them. That's what I get for Cloroxing while wearing anything other than a used burka or a clean room suit. Recalling my mother's dye-jobs - I can't remember what she dyed, other than my organdy First Holy Communion dress, dyed a pale orchid so that it could be repurposed as my party dress for the year - but I do remember those boxes of RIT Dye. (My sister Kathleen reminds me that our mother also redecorated with RIT: dying bedspreads and curtains for a "fresh look.")

(My mother wasn't the only one who tried to give things a new look: I had a Ginnette baby doll and her eyes weren't blue enough for me. So I tried to make them darker, using a Magic Marker. Given my Magic-Markering skills, I managed to both make 'Nettie's blue eyes darker and to wipe out the whites of her eyes. Needless to say, she never looked the same to me, and our relationship ended shortly thereafter. I dumped dolls and started spending all that free time calling in song requests on WORC.)

Back to my dyeing day, when - in hopes of salvaging my robe and sweater - I went store-to-store casting about for some RIT. Well CVS doesn't carry it. My otherwise excellent and pretty complete - given its size - local hardware store didn't have it. Nor did my otherwise excellent and complete supermarket. Each inquiry, however - each made to someone north of 40 - produced a nostalgic sigh. Unprompted, when I asked whether they carried dye, they answered "like RIT?"

Someone in the hardware store suggested Michael's, which has all sorts of craft materials. An excellent suggestion. Michael's not only carries RIT, but it carries both liquid and powder.

I invested in one bottle and two packets, which, while not in the same red box I remember from yore, doest retain the same 30-ish logo, I was pleased to see.

Rubber-gloved, I filled the washer, added the dye (plus the suggested cup of salt) and started dying away. Alas, I must report a somewhat mixed result. The original dye stains were the color of the old Crayola "flesh" crayon. They're now a much for easy-on-the-eye pale purple.

OK. Deep down, I knew that applying dye to the entire garment wasn't going to even things out - just make everything darker. And my robe and sweater really look better than I rationally expected, but of course that's not as good as I'd hoped. The robe remains in service, but the sweater is now retired to indoor use only. The improvement, however, is more than marginal - my eye is no longer obsessively drawn to the flesh-spots -and I was relieved to find that the RIT dye company is still in the busines of making the world a more colorful place.

Wednesday, October 25, 2006

Animal Compassionate

Still, it remains very interesting and laudable that they're committed to decent treatment of animals. I'm sure that we'd all turn into overnight vegetarians - vegans, even - if we really thought for a moment about how our tasty pre-meat is treated. For those (like me) who missed the story the first time around, here's what Whole Foods said at the time:

Animal welfare requirements already mandatory for any meat and poultry sold at Whole Foods Market include:

- No antibiotics or added growth hormones ever.

- Annual affidavit from each producer outlining the raising and handling practices, feed, facility design, environmental conditions, employee training, medical practices, and animal welfare at the farm, in transportation, and throughout processing.

- Annual inspection of each producer's operation by Whole Foods Market.

- Successful completion of an independent third-party food safety audit of each operation's processing plant and a humane slaughter audit according to a rating system developed by world-renown animal welfare and facility design expert, Dr. Temple Grandin.

I'm guessing that today's little flurry of announcements means that Whole Foods (a.k.a., Whole Wallet: let's face it, being kind to our web footed friends doesn't come cheap) has added more species to its list, but I don't know for sure.The next phase of Whole Foods Market's animal welfare standards further underscores the company's belief that the needs of an animal should be the first criteria in the development of standards. The primary focus will be providing environments and conditions for each species that support the animal's natural physical needs, behavior, and well-being. Work on the new "animal compassionate" standards will start with the development of enhanced animal welfare standards for ducks with the goal of completion and implementation by the end of 2004.

Development of standards for each of the other species will follow.

OK, it's easy to make fun of any worry about 'animal welfare standards for ducks' when there's wholesale slaughter in Darfur, Iraq is veering toward irredeemable maelstrom, and the Polar ice-cap is slip sliding into the drink (taking with it the increasingly habitat-less Polar bears). Without becoming a PETA activist, there is something at least partially enobling (and no doubt healthier) about treating our furry, feathered, and finned friends well before we ingest them. But there is also something a little peculiar about it to, since the logical end really seems to be that these guys are bred for slaughter, and real animal compassion would probably involve not eating them to begin with. Then, of course, we wouldn't need all those animals to begin with, so they'd never even have their time on earth, however nasty, brutal, and short.

I sense an existential moment coming on. Aaaaarrrrrggggghhhhh. (Tonight: salad only.)

Tuesday, October 24, 2006

No Period at the End of the Skilling Sentence

But I wasn't impacted by Enron - not directly, anyway - and I'm sure that for a lot of those who were, Skilling's going to jail doesn't really put a period at the end of the Enron sentence. (His getting tumbreled to the guillotine wouldn't be enough for some.) In today's Houston Chronicle, a few of them weighed in:

"We've got a long way to go," said Charles Prestwood, a former pipeline operator for Enron who lost $1.3 million in retirement savings. "We will try to get some money back and it can take awhile." ...

Prestwood would rather have seen Skilling receive a longer sentence, but he said he was looking forward to seeing some of the restitution.

U.S. District Judge Sim Lake on Monday approved an agreement between the government and Skilling's attorneys that requires him to turn over about $45 million to victims of the collapse. "His crimes have imposed on hundreds, if not thousands, a life sentence of poverty," Lake said of Skilling.

OK. Charles Prestwood has a right to be angry. But did he really "lose" $1.3 million in retirement savings? Yes, I'm sure that's what his portfolio, no doubt chocked full of pumped up Enron stock, was worth on paper at some point. I have no idea what a pipeline operator makes, but say Mr. Prestwood contributed $5K of his own each year for 20 years, and Enron fully matched it... Well, I'm too lazy to run the numbers, but I'm guessing a realistic, reasonable value for a normal portfolio under this scenario would be a lot less than $1.3 million. No, what Mr. Prestwod lost was no doubt some of the actual money that he'd earned. But he also lost his hopes and dreams. Maybe he planned on retiring at 50. Maybe he was going to buy a cabin cruiser. Maybe he was going to send his kids to college without having to take out big loans. But it's unlikely that he actually got swindled out of $1.3 million.

And "life of poverty"? Wow. No doubt there were some elderly employees who will never recoup their real losses, but I'd like to see the data on how many are now sentenced to a "life of poverty."

Loyal to the end, Skilling's assistant spoke up for her ex-boss.

"It is my opinion that Jeff Skilling has been persecuted for five years. Mr. Skilling was and still is recognized as a visionary. To lock Jeff Skilling behind bars for the rest of his life would be a greater injustice to this country," Sera told the judge during the ictims' statement portion of the hearing. She, too, had lost thousands in Enron stock, but blamed her own investment decisions for the losses.

Well, the great visionary 'Jeff Skilling has been persecuted' is a bit over my top - talk about standing by your man - but I like the fact that Sera is taking some ownership for her own actions contributing to her portfolio losses. I'm sure there was much in the corporate, Texas sky's the limit culture at Enron that encouraged people to invest in, and stay in, Enron stock. But if something sounds too good to be true, guess what? It probably is. People let themselves get sucked into the Texas pie-in-the-sky that everyone was going to get to be rich.

Who wants to be a millionaire, indeed.

As for Skilling and his partners in crime, the larger question remains, how did these guys get caught up in this? Skilling's a smart, educated guy. Harvard MBA, I believe. And while the MIT MBA in me says, that figures, the point is that here was a guy who knew something about accounting and finance.

Were these guys all "concious criminals"?

I think not.

But they are people who somewhere along the line lost the ability to really examine their actions, motivations, and consciences. They must have all convinced themselves that, by definition, if they were doing something, it just couldn't be wrong. No true north in their moral compasses. Just the quavering arrow of bogus moral syllogism at work.

I'm doing this. I'm a good guy. Therefore, what I'm doing is good.

Even now, it looks like Jeff Skilling can't own up to the fact that he could actually have done something wrong.

There's still no period at the end of the Enron sentence

Monday, October 23, 2006

Risky Business

Yes, there's always the possibility that some employee will snap and take some co-workers out. And obviously there are still many jobs that put workers at peril. (I don't count a 9/11 terrorist attack as a workplace hazard so much as a living in dangerous times hazard. Obviously, it was a work-related death for those hundreds of firemen, police officers, and EMTs, and for the pilots and stewardesses, et al.)

But our economy continues to move away from the reality of actual physical production of goods, fewer and fewer of us ever experience danger on the job.

Stress, yes. Physical danger, no.

If I look back at my own work history, I suffered two very minor injuries over time - both when I had a "real", physical job.

One summer during high school, I worked in a shoe factory. My usual job on the assembly line was polishing the edges of combat boots, but one day I was put on a task that involved pulling nails out of the heels of the boots. For whatever reason, this involved feeling around inside the boots, and no one clued me in that you needed to wrap your fingers in adhesive tape before you started feeling the boot up. In short order, I ended up with shredded finger tips. Fortunately, I did such a bad job with this task that they put me back on edge polishing. (The shoe factory is long closed, of course. I think it became a mattress factory, then got turned into condos.)

I also worked as a Durgin Park waitress for a year, and was badly scalded when a waitress coming into the kitchen the wrong way knocked into me while I was carrying four cups of scalding coffee. Needless to say, I got burnt. Badly enough to be out of work for a week with no pay. (For those not familiar with Boston, Durgin Park is a Quincy Market tourist trap - and probably the only place on earth that serves both Indian pudding and coffee jelly, which I see that they're now calling coffee jello.)

Obviously, there's no comparing my small ills with loss of life in a truly dangerous job like coal mining. I know that for many of those who do this "dirty work", there are few economic choices. Still, it takes a degree of physical and existential bravery that I lack to put on a hard hat and head into the mine each day, knowing the dangers it brings.

Sunday, October 22, 2006

Old Money Wanted

But it reminded me of a story by business writer Steve Bailey that I saw in The Boston Globe the other day about a couple whose application to move into a co-operative building on Beacon Hill was denied. The story fascinated me for a couple of reasons.

For starters, I live just a couple of doors down from this building, and have never really noticed anything all that swanky about it. (I'll have to start looking more closely.) Another thing was the purchase price for the apartment in question, which was given as $700K. Now, anyone who has ever looked at a real estate ad for this neighborhood could tell you that this amount of money won't buy you that much, and certainly is infinitesimally low for a floor-through with over 2000 square feet of space - no matter what condition it's in and how much restoration is required. So that raised a flag for me.

But what was really intrigued me was the "No Irish Need Apply" element of the story - it could have been written 100 years ago - a successful, wealthy, self-made Irish American trying to by in to a co-op building apparently occupied by old, Mayflower money. I mean, this is the kind of lore I grew up on, but it just doesn't sem to happen all that often these days. Certainly, the Boston Irish are firmly entrenched at these points in the Boston ruling class - so entrenched that they don't even bother with the mayor's office anymore, they let the Italians have it. But it's sure an interesting story.

Well, the Walshes wanted "in" to 68 Beacon, but their interview was larded with all kinds of questions about their backgrounds, their kids' educations, etc. What else did they ask? When to use a finger bowl? Whether they cooked cabbage and praties on St. Patrick's Day? Were they papists? I'd love to have been a fly on that wall, although come to think of it flies are probably not allowed on walls at 68 Beacon.John Walsh thought he was living the American dream. Until, that is, he ran head-on into Jonathan Winthrop. The two men come from very different worlds -- and Jonathan Winthrop has every intention of keeping it that way.Winthrop's family came to Boston on the Arbella in 1630 (which followed the more modest Mayflower expedition by a decade), and he is a direct descendent of John Winthrop, the first governor of the Massachusetts Bay Colony.

[Walsh] grew up in a Somerville housing project, and when his father, a laborer, drowned at the age of 47, he left his wife with six kids and no life insurance. Neither of his parents went beyond the eighth grade. Walsh himself dropped out of Westfield State College to go to beauty school.

Anyway, the Walshes were turned down and little Johnny Walsh from Somerville is not going quietly. (If the jut-jawed snobs in this building didn't like little Walsh before The Globe article, they're sure not going to like him any better now. (By the way, co-operative boards can turn you down without disclosing why.)

I'm sure there was a complete element of snobbery in this, but it's probably not so much that John Walsh is Irish - it's the hairdresser business, the Westfield State drop-out "thing" - I can see that the co-op people must have been thinking 'he's just not our kind.' If he'd been a poor Irish kid from Somerville who made it out and gone to Bowdoin and "the B-School", and made his $$$ as an investment banker, learned the rules of polo and forgotten he ever knew how to bet a quinella at the $10 window at Suffolk Downs, I'm sure he'd have made his way in.

No, John and Kathleen, snotty and off-putting as the co-op members are, you're probably not their kind. And guess what: you probably wouldn't like the Winthrops much, either.

I'm sure the Walshes will be able to find someplace to live on Beacon Hill. They may have to pay more than $700K for something they'd like. But they'll be more than welcome. (If there were a unit in my building up for grabs, I'd love to see them here - we're only a few doors down from 68 Beacon, but the condos in our building are a lot smaller.)

With apologies to William Shakespeare. Some are born old money, some achieve old money, and some have old money thrust upon them.

And sometimes new money just isn't as good as old.

Saturday, October 21, 2006

Lawn Flamingos Fly Into the Sunset

My parents didn’t go for them, so I grew up kind of deprived, but I’m no stranger to lawn ornaments. In our blue collar neighborhood in Worcester, most of the local lawn-deco was of the Bathtub Madonna variety, but someone around the corner had little Dutch girl and boy statues in their front yard, and someone else had a plaster donkey cart. Cement birdbaths were pretty common. My grandmother had one in her yard on Winchester Ave, and I loved to run my fingers through the luke-warm, slightly greasy water and draw my initials in the basin’s scum.

My other grandmother lived in Chicago, and the highest point of our bi-ennial trek to 4455 North Mozart was a visit to the Elf House. We wouldn’t be in Grandma’s door for five minutes, when we’d be badgering my father to take us there. A couple of blocks away from my grandmother’s, the yard of the Elf House was full of – as you have cannily guessed by now – statues of elves. Elves on swings. Elves playing cards at mushroom card tables. Elves pushing baby buggies. Elves mowing lawns.

If I remember correctly, the Elf House sat on a corner lot, and had a more extensive yard than most of the bungalows in the area. It also had trees in the yard. (It was a shady neighborhood, but most of the trees were on public ground, so this was unusual.) Naturally, there were elves perched in the trees.

When visiting Chicago, most of our time was actually logged at my grandmother’s summer house in Lake Villa, up near the Wisconsin border. Now part of the suburban sprawl zone, Lake Villa in those days was the country. There were corn fields just across the dirt lane from the Lake House (also called the Country House), and a duck farm just down the road. (Sometimes the ducks escaped and waddled up our lane.) The house was on Sand Lake, which would have been more correctly named Muck (or Leech) Lake. From the kids’ standpoint, the niftiest features of the Lake House included the fake wishing well and the fieldstone windmill* that my grandfather had built sometime during the 1940’s. The windmill, which had lots of little colored glass windows in it, was particularly fascinating, since you could peer in the little windows - half of which were broken - and look at dead bugs.

I craved a mini-lighthouse of my own, an elf on a swing. I could not understand why we didn’t have any lawn decoration at home. The best my parents came up with was a wooden tub filled with geraniums. Bor-ing

Still, even my parents liked to look at lawn stuff.

Along with playing Canasta, and singing along with Mitch on Friday nights, going for rides was a major source of family entertainment, and driving around Worcester County made us all something of lawn ornament connoisseurs. We would have liked the Statue of Liberty on Shrewsbury Street better if it was authentic verdigris, rather than terra cotta. We loved the place in Paxton that had the little pond out front with the sailboats in it – so classy it almost didn’t count as lawn decoration. We hated the Madonnas stepping on the snakes – especially if the snake was painted a livid green with a bright red tongue. Worse still if the snakes were making big googly-eyes. Our collective favorite was the gazing ball – silver, blue, green – it didn’t matter. (Hey, I still want one.)

We didn’t particularly like flamingos. They seemed flimsy, chintzy, tacky. We actually made fun of people with them in their yards.

Still, it is with a pang that I see that the makers – and originators - of lawn flamingos, Union Products of Leominster (which, I will note, is in Worcester County*), is closing its doors on November 1st. Union is selling the molds to another company, but it won’t be the same.

No, if I had a yard, and if I were going to put any lawn-deco on it, I’d pick a gazing ball, not a flamingo. Yet I am saddened by the passing of Union Products. I may try to buy a flamingo or two before they disappear entirely. I have no use for it myself, but my Aunt Kay still owns the Lake House. Perhaps I can get her one.

I can see it now, staked next to the windmill, peering in through the window, eying the dried up bumble bee carcass, the spider dead in its web.

* Thanks to my cousin Ellen for reminding me that this was a windmill. I'm such a New Englaner, I remembered it as a lighthouse.

**Which also gave the world the Smiley Face.

Friday, October 20, 2006

Badmouthin' the Boss

So, although I do not like her. Although I think she deserved to be put on the spot. Although I think she deflected the question deftly enough, I had a teensy twinge of sympathy for Lt. Governor Kerry Healey when she was asked to repudiate her boss, Governor Mitt Romney, during last night's debate in Boston.

For those not yet following the 2008 presidential campaign, Governor Mitt is circling the country, badmouthing Massachusetts as he tries to curry the approval and support of the Republican right-wing. Instead of traveling around making the case for businesses to relocate in our fair commonwealth, he is instead portraying the state as out of the mainstream and wacko (largely because gay marriage is legalized here). OK, a lot of Mitt's making fun of Massachusetts takes place in South Carolina, and it's unlikely that any of their chicken processing factories are going to relocate up here, anyway, but it's still unseemly for the governor to trash-talk his state the way Mitt does. If he hates it so much here, why not leave now? Believe me, we won't miss him.

Below is a transcript of Kerry Healey's exchange with one of the debate panel members. I'm not sure who "Allison" is, and I couldn't find a reference to her full name and affiliation in the debate transcript, but she's a reporter:

ALLISON: Ms. Healey, in his frequent out-of-state travel. Governor Romney has often made Massachusetts the butt of jokes. These are comments that many feel have not only disparaged the state but may also hurt the state's ability to attract business and new citizens. Would you take this opportunity to publicly criticize Governor Romney for the potential harm he's done to the state and would you call on the governor to cease and desist?

HEALEY: Let me just say that I love Massachusetts. I love it in a way that someone who chooses their state loves it. And I came here back when I was going to college. I had the great opportunity to come here to go to college and I have to say that it impressed me as a place that has fantastic history looking at this hall. You can see and feel the history of this state. It has families where generation after generation live in the same town, stay together. I love Massachusetts. I'm going to work to make it a better place and I will never criticize it.

ALLISON: And would you call on the governor to cease and desist.HEALEY: I think he's probably heard your message loud and clear.

Now this is pretty much one of those no-win, 'have you stopped beating your wife' questions, and I think she answered it decently enough, distancing herself from her boss by saying "I will never criticize" the state. But in terms of the debate, she actually came across as losing points on this one.

I'm sure that Ms. Healey does plenty of private grousing about Mitt, and how he's not helping her any. And whether she publicly calls on him to 'cease and desist' may be the least of her worries. (The latest things she's getting slammed for are a ridiculous 'just-in-time-for-the-election' play to eliminate turnpike tolls, and the increasingly scurrilous tone of her attack ads on Deval Patrick.) But it's hard to be put in the position of publicly criticizing your boss when he hasn't done something illegal or out-and-out evil, when he's just acting like the pol that he is, doing anything for the vote. Still, given than Mitt isn't doing all that much to support her candidacy, Healey could have put a little more distance between them without looking like she was criticizing the boss.

Thursday, October 19, 2006

Why Me? (Got the Pink Slip Blues?)

Unless your working at Ford, where the lay-offs are so wholesale and structural, you're more likely to be laid off in a pick-and-choose situation, in which someone is picking you rather than the guy in the next cubicle.

Let’s face it, this is personal.

It's only human to ask ‘why me?’

Having lived through over two dozen rounds of lay-offs over the course of my career, and having been on the picking and choosing end of things on a few occasions - and having been among the chosen as well, I can tell you ‘why you’.

Sometimes, although not often, there’s a performance problem - and if this is the case, you're probably at least vaguely aware of it. You may have gotten a less than stellar review. You may be in a position where the job is not a great fit but you haven't done anything about it. You may have seen everyone else in your position move up and on, while you've stagnated.

It's not pleasant to think of yourself as such, but lay-offs are a great way of sweeping out deadwood. Plain and simple, it may not be great management practice, but it’s a lot easier to deal with a problem child in the “neutral” setting of a lay-off. So many managers, hoping to avoid the unpleasant task of confronting a performance issue head on, will wait for a lay-off to occur. During an early round lay-off at Genuity, one in which my group was not affected, I was asked if I wanted to take the opportunity to get rid of any problem employees. I had one, but I kept him in reserve knowing that another lay-off was inevitable, that I would be asked to reduce headcount, and that the number of names I would have to fork over would be the same whether I got rid of him now or not. So I stock-piled him, and six months later he was gone.

Sometimes the people getting laid off just don’t fit in with the culture. Outliers, odd-balls, hiring mistakes… there may not necessarily be a performance problem, but if someone doesn’t fit in – the guy wears a jacket and tie in a jeans and flip-flops workplace, the uptight woman who radiates disapproval whenever someone tells a joke – unless they have some skill or knowledge that no one else has, at lay-off time they’re gone. If you're someone who's been uncomfortable in the culture - you don't like the in-jokes and horseplay, or you're the one always trying to goose a really dull environment into something higher up the conviviality scale - it may well have been your demise.

There’s a recurring response to every lay-off I’ve ever been through: the complaint that the “little guys” are hit disproportionately when it comes to lay-offs, that more junior people are too often let go. Well, having thinned the ranks of my team largely at the expense of the more junior people, I can only say that bringing on less experienced people to join a group is a growth strategy, not a contraction one. When I had to cut 6 of the 16 people in my group, I had to keep the ones I knew who could do the most with the least supervision, the ‘been there, done that’ folks rather than those in learning mode who required a lot of my time, and the time of the more senior members of the team. I couldn’t afford to keep the newbies; I needed the old hands.

Another complaint is that those who ‘tell it like it is’ are often laid off. Yep, they are. Although I personally have high regard for the truth seekers, preferring their company to that of the cheerleaders, sometimes ‘telling it like it is’ comes across as pissing and moaning. And, frankly, after a lay-off, a manager may just want to keep those who will put their heads down and PLOW, rather than those who, however correctly, keep letting you know that all that’s happening is the rearrangement of the deck chairs on the Titanic. Unless they are completely non-productive, the “tell-it-like-is” brigade are seldom let go in the early rounds. But when it comes to the later rounds of lay-offs, when the skills are relatively evenly matched in a group and the choices harder, most managers will dump the malcontents. Grousers beware!

Sometimes your project, your product, your business line, gets canceled. Sometimes they just do away with your function, viewing it as a luxury in tough times. Sometimes the other person who does the same job you do does it just a shade better. Or knows more. Or has been there longer. Or is protected by someone “higher up” (who knew that this guy was married to the president’s niece?). Sometimes you irritate your boss. Sometimes you irritate your boss’s boss. Sometimes it’s a toss-up. Sometimes it comes down to a decision to keep the guy who’s wife just had a baby, and let the woman go whose husband has a great job.

As lay-offs go on – and I can’t think of any company that ever had just one lay-off – the decisions get harder and harder. It’s hard not to take it personally. It is, after all, you, and it doesn’t get much more personal than that.

But it’s just a numbers game.

Why you?

Why not you?

Wednesday, October 18, 2006

Turkey Shoot – Jack Welch on Underperforming Employees

Chairman Jack, or ex-Chairman Jack, is lecturing at my alma mater, and his class, Conversations with Jack Welch, has gotten a fair amount of play in the press of late. One of his rants, errrrr, conversations is about underperforming employees, and he’s quoted as saying “If you’ve got 16 employees, at least two are turkeys.” Later on in the widely-circulated article I read, there’s a further reference to “not bothering to improve the performance of underachievers in the bottom 10 percent of the company’s work force,” which Jack has an answer for. Show them the door. (I like this shot of Jack: it looks like he's getting ready to strangle on of those turkeys.)

I’ll look past the little arithmetic discrepancy here: 16 employees/2 turkeys = 12.5 percent, not 10 percent. (Noticing things like that is just the Sloan School MIT quant jock in me.) More to the point, I don’t know what he bases this little piece of wisdom on, but like a lot of “fast facts” it makes sense on the surface, but doesn’t really stand completely up to scrutiny.

It’s the difference between absolute and relative standards. In absolute terms, you indeed have all employees who are performing up to snuff. No, this is not a case of Lake Woebegone-ism, in which all employees are “above average.” But, especially when there is a small sample/small company, it is entirely possible – practically and statistically – to get decent performance out of everybody. The greater the number of employees, of course, the greater the – practical and statistical – likelihood that you will, indeed, have some turkeys. But 10 percent or 12.5 percent strikes me as arbitrary.

Speaking in relative terms, however, by definition there will always be a bottom 10 percent. You may have to keep looking for reasons to put someone in the bottom 10 percent, but you will certainly be able to find them.

But routinely and definitionally declaring that the bottom 10 percent must go doesn’t make any sense to me. It sounds okay on paper – and who can argue with wanting to raise the bar. But doing an annual or quarterly purge of the bottom x percent strikes me as a recipe for all kinds of bad behavior on the part of managers and employees, and bad morale, as the witching hour for determining who’s on the bottom of the pile this round comes up. It strikes me that this can work – sort of – when there’s an objectively measurable way to determine who’s on last: sales results, production quotas. But where the standards are less quantifiable, watch out.

This is not to say that managers shouldn’t get rid of their “turkeys.” As a manager, you know it when an employee is just not going to work out. Second chance, yes. Third chance, maybe – if the circumstance are really extenuating – but there does sometime come the point where you really need to part company with an employee. And guess what? As often as not, the employee “in question” knows that they’re not a fit. They may not want to be unemployed, but they may be relieved to go.

I had one “problem child” whose performance was incredibly erratic. But she played me like a harp, sensing perfectly when I was about to lower the boom and employing self-preservation tactics that coupled improved performance (to the extent that I would question whether there really was a problem) and a personal sob story. After I got suckered a few times, I sat her down and we worked through an exit strategy. Turns out, she’d knew things weren’t working out and she’d been looking for a job. Did she turn out to be someone else’s problem child or Golden Girl? Not my problem.

Jack may not be right about the percentages, but sometimes you have to call a turkey a turkey and fire away.

Friday, October 13, 2006

Courts to WalMart: You Gotta Start Giving Employees a Break

WalMart broke Pennsylvania labor laws by forcing employees to work through rest breaks and off the clock, a jury decided yesterday in a decision plaintiffs' lawyers said would result in at least $62 million in damages. Jurors determine damages today in the class-action lawsuit, which covers up to 187,000 hourly current and former workers.

"I think it reinforces that this company's sweatshop mindset is a serious problem, both legally and morally," said Chris Kofinis, a spokesman for WakeUpWalMart, a union-funded effort to improve working conditions. The Bentonville, Ark.-based retail giant is facing a slew of similar suits around the country. Wal-Mart settled a Colorado case for $50 million and is appealing a $172 million award in California. The company declined to comment yesterday because of the pending deliberations over

damages.

The Pennsylvania jury deliberated for several hours after a five-week trial. Jurors found that Wal-Mart acted in bad faith but rejected claims the company denied workers meal breaks. Wal-Mart, the nation's largest employer, earned about $10 billion in 2004.

The Pennsylvania case involves labor practices at Wal-Mart and Sam's Club stores between March 1998 and May 1, 2006. Lead plaintiff Dolores Hummel claimed that she had to work through breaks and after quitting time to meet work demands in the bakery. She said she worked eight to 12 unpaid hours a month .

"One of Wal-Mart's undisclosed secrets for its profitability is its creation and implementation of a system that encourages off-the-clock work for its hourly employees," Hummel said in her lawsuit, which was filed in 2002. The plaintiffs used electronic evidence, such as systems that show when employees are signed on to cash registers and other machines, to help win class certification during several days of hearings last year

Yet another chapter in the ongoing downtrodden workers vs. rapacious behemoth saga which will continue to be played out over the next few decades. (And while I do believe that WalMart employees are downtrodden, and that the big-box stores despoil both the landscape and small town/city culture, and that WalMart is driving down quality by letting price trump it every time, WalMart does provide a lot of jobs (however terrible) and cheap goods (which we arguably don't really need is such vast quantity and array). Obviously, it's a juicy story because it involves the company that everyone loves to hate (or hates to love). But it's a really interesting story with so many threads connected to the ongoing shifts (and rifts) in our economy and culture: loss of manufacturing jobs (and a middle class existence for blue collar workers), globalization (which is, of course, both good and bad news), the religion of rampant consumerism, technology innovation (and invasion), race to the bottom pricing (in the end, who wins that race?)...

Enough: I'm not an economist - I'm just married to one. But I've worked enough lousy retail jobs in my life to know that every four hours or so, you really deserve and need a break. WalMart needs to start giving them to its folks. (Sometimes it's hard for those of us who work in jobs that don't involve a punch-card to imagine what it's like to be on one.)

Thursday, October 12, 2006

How Deep the Options Scandal

McAfee, the No. 2 maker of anti-virus software, said Chairman and CEO George Samenuk resigned, fired President Kevin Weiss and announced plans to slash 10 years of previously reported profits by as much as $150 million. Cnet, the online publisher of technology news and reviews, said CEO Shelby Bonnie and two other executives stepped down after an internal probe found the company backdated some stock-option grants.

The toll from backdating continues to mount. More than 30 officials, including eight CEOs, have left companies under scrutiny for manipulating stock options to reward employees, and executives at two, Brocade Communications Systems Inc. and Comverse Technology Inc., face criminal charges. More than 60 companies -- from Apple Computer Inc. to Cablevision Systems Corp. -- have restated or plan to revise earnings.

"It's getting worse before it gets better,'' said Howard Silverblatt, an analyst at Standard & Poor's in New York. "The issue will become more widespread as more companies are coming forward voluntarily instead of waiting for official inquiries.''

At least 140 companies have disclosed federal investigations or internal probes of potential stock-option manipulation. The Justice Department, the Securities and Exchange Commission, the Federal Bureau of Investigation and the Internal Revenue Service are among the agencies running civil or criminal probes.

Scratching the Surface

Meantime, investors have filed more than 230 lawsuits seeking compensation for the profits that executives and other employees made from improper grants and the earnings misstatements that may have resulted. "I think we have scratched the surface,'' said Derek Meisner, a partner in the Boston office of Kirkpatrick & Lockhart Nicholson Graham LLP who's advising companies he declined to name on whether to terminate executives over stock-option manipulation. "You are going to see more of it as companies conclude internal investigations and the SEC completes its investigations. This is kind of the tip of the iceberg.''

Backdating, the most serious abuse, involves retroactively pegging options to an earlier day when a company's stock was trading at a lower price. When the stock rises, holders of backdated grants can buy shares at artificially low levels and pocket the difference. If not disclosed to shareholders, backdating can be considered fraudulent. The practice hides compensation costs, reduces income-tax payments and overstates earnings.

Yep, backdating is certainly a lousy thing to do to your shareholders, but it is also an exceedingly low and sleezy thing to do to the rank and file employees who got the plain vanilla options. Here they were, watching the stock price and their exercise date, trying to forecast whether they'd be able to buy a new car or a flat-panel TV or even a new raincoat on the big day...No doubt in most cases what they really needed to buy on exercise day was a snorkel, because those options that seemed so promising the day they got them were now well under the water. I've lost all track of how many loser-ama options I was granted over the years. Every once in a while I find some old file with an option granting letter in it. In the rare case where the company still exists, I might do a check to see whether they EVER would have been worth anything. I'm seldom re-disappointed.

But I know that if I found out that the executives in my company had been backdating or otherwise manipulating the game so that they could win even bigger time than they already were, I would have been colossally pissed off.

Blessedly, the only options I have now are in a very small company, run by very honest people, where there's actually a less than zero chance that they'll be worth the paper they're printed on at some point. And blessedly (I guess) I have few enough of them that I don't expend one iota's worth of time fantasizing about what I'll do if they pay-off (which was certainly not the case with some of the larger pots o' options I've had in the past. Hmmmm, early retirement? House in Maine? Life of philanthropy?)

Meanwhile, I'm just as happy I don't use McAfee, those weaselly bastards.

Wednesday, October 11, 2006

Irrepressible, that's what you are

Now "irrepressible" is a great word, but it's not one you hear every day. And of course, even with their sluggish stock price etc., the boys from Redmond still have the money and force to "keep coming, and coming and coming. and coming..." - a scary thought, but there you have it.On the subject of search engines, for example, Ballmer acknowledged that Microsoft was not the first and might not yet be the best, but it will not be counted out. "We just keep coming, and coming and coming and coming and coming and coming and coming; we are irrepressible on this," Ballmer said. "The bone doesn't fall out of our mouth easily."

But back to "irrepressible". My only association with the word is ads for old re-runs of Ozzie and Harriet in which Ricky Nelson was tagged "the irrepressible Ricky." Well, Rick Nelson turned out not to be all that "irrepressible," but I'm sure that MSFT will prove more so. Who knows? Maybe Google will buy them.

*Link may require a log-in.

Tuesday, October 10, 2006

You, Tube, Can Become a Billionaire!

For whatever reason, this puts me in mind of an early episode of NYPD Blue in which some old guy befriended Johnny Kelly/David Caruso and left him $50K a year when he died. The entire plotline seemed strained and incredible to me. All I could think of was that the writers had become attached to their character and didn't want him living on the chump change of cop's pay.

Everything has become so inflated, we've lost all sense of what's reasonable. If the numbers aren't stratospheric, they just dont' matter. Scott Godin's got it wrong: it's not Small is the New Big, it's Big is the New Small.

We'll see what marvelous "synergy" the GoogTube deal results in. Maybe this will be the deal that brings the world back to a more sane footing.

Monday, October 09, 2006

Lap of Luxury: Gramercy Park Hotel

My friend Michele and I were in NY to do some client training, and our hotel reservations got somehow screwed up. It was mid-December, and the hotels were packed, so corporate travel asked if we were OK staying at the Gramercy. I had seen little ads in the back of The New Yorker and figured, how bad could it be? (Our hint about how bad it could be should have been the price, which was less than half of what you'd pay for a decent hotel in NYC at the time.)

When we showed up, the lobby was a little on the shabby side, so when they asked us if we wanted to share a suite or have single rooms, we opted for the suite. We got on the elevator - accompanied by several old men in bathrobes, slippers, and goosebumped turkey-white legs who appeared to be coming from/heading to a card party.

The living room of our suite was straight out of the 1950's: beat up maple coffee and side tables (with cigarette burn "decorations"). Swoopy "moderne" lamps. Turquoise stretchy upholstery with gold threads. (I couldn't imagine the naked-leg old geezers were sitting on those scratchy couches without throwing a towel down.) The bedroom part of the suite had two lumpy old beds, in similar 1950's motif. In the shower, you needed an umbrella to keep the cold web plaster off your back.

After a nice dinner at Caravelle - actually quite modest, and in any event justified because we were paying so little for the hotel - we got back to the Gramercy Park, got into our lumpy beds and started to laugh thinking about how our mothers were probably sitting there in Worcester imagining the glamorous business travel experiences of their MBA daughters.

The capper was when we checked out in the morning and they'd put a $500 charge on Michele's credit card. (They were supposed to be charging us each $50.)

With the minimum room rate of $500+ that the hotel now charges, I guess we were just in the price vanguard. (Maybe we were an early test case.)

Moneyball: Do You Get What You Pay For

Still, it feels so good to see the Yankees out of it, so sweet to savor this little fiasco as it played out. Just how apopleptic is Steinbrenner? Will A-Rod get tossed (and land - yikes - in Fenway)? And, of course, The Nation's personal favorite, Johnny Damon, claiming that even though they lost they still were the best team in baseball (sniff, sniff), a lot in thanks for having brought him on for the season.

The beat down of the Yankees, of course, does seem to bring out the business analyst in me. And the payroll numbers when you look at them are just staggering. I found a listing of the 2006 MLB payrolls (from April, so it doesn't include expensive intra-season pickups like Abreu, which punched the Yankees over $200M). Abreu or not, based on these numbers, three of the teams that made the playoffs (Padres, Twins, and A's) had below average (mean and median) salary figures. OK, only the A's are still standing in this pack, but it's still impressive.

Tigers and Cardinals, who both made it to their respective LCS's are not that far above average. And of the three big-money teams that made the playoffs (Yankees, Mets, Dodgers), only the Mets (number 5 out of the 30 MLB teams) are still in contention. As for the remainder of the top six big-money teams, "our boys" finished a poor third in their vision, as did the White Sox. The Angels came up second in theirs. At least they were all in the hunt for the season (excepting the Red Sox, in retrospect completely out of it post-All Star Break). The next team down (number 7 in payroll) is the Cubs, who finished dead last in the NL and had the thir worst record in baseball.

So do you get what you pay for? Yes and no. Most of the teams with the fatter wallets at least make a good run for it. And the guys with the tiny coin purses mostly end up well down in the standings. But it's not true across the boards.

Baseball is business, but it's a business unlike most others. When I think about the companies I worked for over the years where investors threw good money after bad and where we never broke even, it doesn't look all that different than the Yankees of late, does it? Except that in the real business world, investors eventually throw in the towel and you're gone. In baseball, it takes a lot longer - if ever - to pack it in, and then the teams ("companies") rarely get fully dissolved. They just find new owners, new cities, and new fans.

In any event, I can now watch the playoffs with full enjoyment. I have a team to root for and I can do so without the pit in the stomach anxiety that goes along with the Red Sox losing and the Yankees winning. Go Tigers! (Fourteen out of 30 in the spending ranks. Pretty good ROI so far.)

Saturday, October 07, 2006

No Way to Shop!

When it first started its shutdown (which was some type of squeeze play that emptied out one floor at a time), I walked through with tears in my eyes. My sister Kathleen had the same experience.

There’s something really lost when the local stores go, especially for those of us who grew up with them. (When Macy’s took over Jordan Marsh a couple of years ago, and got rid of its name, I didn’t feel quite as bad. I suspect that’s because I grew up in Worcester, which had a Filene’s but no Jordan’s. The fact that everyone still calls the Macy’s Jordan’s helps, too.) Still, I’ve been in Boston long enough to be a Bostonian, and most of the stores that were here when I arrived are long gone: Gilchrist’s, R.H. Stearns, S.S. Pierce, Lechmere Sales, Raymond’s.

All more of the same: the world getting homogenized and blah’d out.

As someone who’s half-Chicago, I also feel aggrieved at the loss of the Marshall Fields name. A big treat on our Chicago visits was a trip downtown to Marshall Fields mother-store in the Loop, where we’d buy a box of Michigan Mints. And it’s not just the states. Although I think the only thing I ever bought there was a travel clock that ticked too loudly, I felt bad when Moon’s department store in Galway was taken over by the big Dublin store, Brown Thomas.

Big fish eat little fish. Hyenas grab the limping gazelles. Business is business. Business is hell.

I actually like living in a world where there are some differences between places. That’s why they’re called different, isn’t it? I like hearing regional accents, window shopping new stores, watching the news on someone else’s local TV. Does everything really have to be the same?

Why can’t Macy’s just use their über brand, and keep the local name going? Filene’s: A Macy’s Store. Marshall Fields: A Macy’s Store. Come on, how much more would it cost to plunk in the old name and logo on the bags, in the ads?

It will be interesting to see if Macy’s strategy works out, if people forgive and forget or just take their Filene’s and Marshall Fields spending habits and years of built up brand loyalty and go elsewhere.

Filene’s is Now Macy’s. Marshall Fields is Now Macy’s. Well, no they’re not.

Jury’s out on whether Macy’s will live up to it’s tagline and become the Way to Shop! for Bostonians and Chicagoans.

Friday, October 06, 2006

Tee'd Off: Why I'll Never Be a CEO

The other day, though, I realized that there was another reason I'll never be Ms. Big: I don't golf.

I was with a client the other day, sitting in on a meeting with one of his firm's business advisors and the conversation turned to what level we should be selling into. To illustrate his point, he told us of a recent exchange he'd had with one of his employees. It seems he'd sent a crew out to a major industry convention, and called one of them to see how it was going.

"Which of our prospects are you golfing with this afternoon," he asked.

"Oh, I'm seeing Joe Blow from International," his guy answered, "But we're not golfing. He doesn't golf."

"Then you're talking to the wrong person at International," he was told.

So it seems that if you don't golf, it's not possible for you to be at the vaunted "C level."

I don't mind the tought of walking around a golf course occasionally whacking at a little white ball, but my powers of concentration are just not geared to focusing on where the little white ball actually goes. I know from my mini-golf experience that, after the first couple of holes, I'm past caring whether I get a hole-in-one or hit the limit and take the "5". I just don't find it all that interesting or worthwhile. I'd rather be focusing on the dynamics of my foursome, or trying to figure out the relationship of the folks just ahead of us, or gauging what a gold-mine the mini-golf operators are running.

So advice for those who want to get to the Big C: pick up a Big Bertha, get yourself a natty windbreaker, and hit the links.

Thursday, October 05, 2006

The HP Spy Ring

Now, a story with traces of Sam Spade and Kim Philby - that’s a lot juicier than green-eye shades, sleeve-garters, and spreadsheets.

What’s getting lost in all the ‘what did Patricia Dunn – and, now, Carly Fiorina – know and when did she know it?’ – is the fact that the Board of Directors is still fully intact, and the new chairman of the company is inheriting a group that he in no way shape or form can fully trust. After all, the entire spying fiasco started because some Board member was doing some sneaky tell-all to the press. I guess it would be too much to expect that the guilty Boardie would fess up (or at least quietly resign). Good luck to Mark Hurd at his next Board meeting!

P.S. I’m not one to play the automatic gender card, but I do suspect that this would be less of a story if it didn’t involve a woman-led (Dunn) company, that was previously run by one of the most visible women in the technology world (Fiorina). Maybe it’s just fairplay – treat the girls the same as you treat the boys – but there seems to be a tiny little element of glee that there’s a woman in the center of this whirlwind.

The HypoAllergenic Cat (Here Kitty, Kitty, Kitty)

At $4K a kitty, I don’t know how many cats they’ll sell, but after getting over my initial reaction – what the ??? – I don’t think it’s all that bad idea to have a non-sniffling, wheezing, coughing, itch-producing cat on the market. Hey, I’m a dog person, and the only cats I’ve ever really been fond of are those that exhibit dog-like traits, but if someone really wants a cat and hasn’t been able to live with one, this must be a dream come true.

What was really interesting about this story – other than the fact that it underscores my continued belief that we have an infinite economy capable of producing anything imaginable – was the cat-loving couple it chronicled. Although the woman of the house was a cat lover, despite severe cat allergies, she persisted in keeping company with cats.

Well, I certainly have sympathy for someone who's so "determined to have a kitty." And I hope that these folks will be able to work things out. But I’m sure glad that I’m not the manager of someone who would have to stay out of work for four days because she deliberately introduced a second cat into her midst knowing that she had severe allergies. This makes no more sense to me than someone who’s allergic to shellfish pigging down shrimp. Or someone with hay fever rolling around on the new mown lawn. Yes, it’s sad that you have to miss out on these pleasures, but sometimes life hands you a lemon. And if you have citrus allergies, well, you just don’t squeeze that lemon into your mouth, do you?"As strange as it may sound, for us the price would have been worth it; it would have saved us money and saved us pain from all the medical and also emotional problems," said Christopher Cullen, of New York, whose girlfriend's worsening allergies this week forced them to put up for adoption their beloved cat, Cimbi -- a feline who had achieved "mild Internet notoriety" as the star of her own website.

Cullen and his girlfriend, Cheryl Burley, have fought a losing two-year battle to engineer a tolerable coexistence with Cimbi, because Burley, a devoted cat lover, has had cat allergies since childhood. On http://www.harlemfur.com/, you can watch Cullen, who works for the New York Senate Democratic Conference, giving Cimbi a bath to reduce her allergen load; he takes Cimbi on a leash to Morningside Park for a day to give his girlfriend's allergies a break.

The couple never put down carpets; they installed special air filters and vacuumed incessantly. But Burley's symptoms worsened in recent months, and that fragile equilibrium fell apart two weeks ago when they took in a second cat, Marley, which turned Burley's allergies from annoying to overwhelming. She couldn't work, couldn't breathe, and had a seizure.

"Our whole life has gone downhill -- I missed four days of work, I'm back on inhalers, eye drops, and creams," Burley said. "This hypoallergenic cat would be a perfect solution for me. I'm determined to have a kitty."

(Did you hear about the woman who slept with cats? Yes, Mrs. Katz. Am I the only one who thought of this old joke when reading about the hypoallergenic cat?)

Tuesday, October 03, 2006

Home, Home on the HP Range

And I really don’t want to think about how boring life would be if disparagement were outlawed! Who wants to live in a world where seldom is heard a disparaging word. That’s no fun.

Of course, it does strain credulity to think that the directors who left HP’s board over the spying scandal won’t be getting off a couple of one-on-one, just between us big-boys, disparaging words about goings-on at HP. I’m sure it will all come out in the book that some enterprising business journalist (or ex-HPer) is already typing up a proposal for. Should be a good one!